What’s the deal here?

I don’t know if you’ve heard about this man, Bill Ackman but there’s definitely more than one man in the States with that first name who has made a good amount of noise, this time not in Silicon Valley, but on Wall Street. By the end of this piece, you’ll know for yourself who I’m talking about (if you already don’t) and how that man changed your life, forever.

A SPAC stands for a Special Purpose Acquisition Company. Back in the day, SPAC meant dirty money, today it has transformed into a beacon of economical hope for thousands of investors globally who place a higher value in these, over conventional investments.

Some FAQ’s & myths about SPAC’s.

- SPAC’s are essentially shell companies, aren’t they?

- SPAC’s are no different from VC, are they?

- How different are SPAC’s from private equity & leveraged buyouts?

- Why a SPAC over a conventional merger?

- Does India have SPAC’s?

By the end of this piece, I promise to bust all myths and answer all questions, hold your horses while you read on.

What’s A SPAC, really?

Think of a SPAC like a basket you take when you walk into a supermarket. You have a definite amount of money to shop for, you know broadly the things you want to buy (companies you want acquire in the case of a SPAC), you have been entrusted with the shopping because of your credibility & experience in the field and finally you buy some time for yourself, to look around, at what’s it that you really want for your owners, ask a lot of questions, read, research, investigate about the products (targets in case of SPAC’s) and finally after a considerable amount of work, fill up the basket with what you think derives maximum value for your owner.

Fairly similar to Private Equity & LBO’s, SPAC’s consist of professionals (sponsors, in SPAC terms) raising money from investors, and using that capital sometimes with a combination of debt to acquire operational businesses.

SPAC’s raise their capital through an IPO, just like a conventional company would raise money while offering a stake in the issuing company. This begs the question? Why not continue investing in conventional IPO’s?

Well, the answer is not that straightforward. The risks of investing in a company make investors skeptical of their returns, One of the most valuable companies in the world, Apple Inc., in its latest annual report listed about 24 conclusive risk points, the company faces at all times, potentially making the company go bust.

Well, that’s not really the case with SPAC’s, SPAC’s are an investment pool, and it is different from a conventional company on an IPO, it’s a set of qualified and highly credible fund managers sitting behind these funds, with really the knowledge and expertise of making the size of the initial basket much bigger from where it started of.

A classic example is the case of Lordstown Motors, a company which is just one year old, would typically see a Series A or B round of funding after it’s seed round, this early into its company life cycle, but instead it chose to merge with a SPAC (DiamondPeak Holdings Corp.) and simply, go public. This is just one example among the various companies such as Nikola Motor, Fisher Inc., Shift technologies, Velodyne Lidar among many more.

Better known in common parlance as “blind pools”, “clean shell companies” or even “blank check companies”, SPAC’s have created quite a storm this year, but don’t go for my word until I tell you that 55 SPAC IPOs took place, collectively raising a whopping $22.5 Billion so far in 2020. In fact the market is impressed with SPAC’s to such an extent so as to even see an ETF (Defiance NextGen SPAC IPO ETF) which would invest 4/5th of its total portfolio in SPAC’s and the remaining in company IPO’s, think of it as an investment into an investment, much like commodity options which are a derivative (option contract) of a derivative (commodity futures).

How does a SPAC work?

When investors park their money in a SPAC, about 90% or a higher percentage of the funds raised, are deposited in a trust, paying interest on that money, so even if at the end of two years (typically 18-24 months for a SPAC to complete the merger), no business combinations go through, your opportunity cost is taken care of. Best part: you can withdraw anytime you feel your money can be put to better use, elsewhere.

A typically SPAC IPO would be priced per ‘unit’. Each unit would consist of a share and a 1/xth of a share warrant, understand it this way, if I have one share and 1/3rd of a warrant, then you’d want 3 warrants to allow you to purchase that share at a predetermined price and date, much like a call option, minus the lot size requisite.

The difference really lies here, are you willing to keep the money with these managers who arguably claim that your money is smarter, when it’s with them, as compared to direct investment in IPO’s/ Venture Capital/ Private Equity from the investor side and the difference for companies is really to bypass/circumvent the nuances and intermediation of the conventional IPO process.

The Bill Ackman Factor

SPAC’s aren’t about just one man, but a lot of how SPAC’s are going to be viewed henceforth is dependent on what he makes off them. Let me introduce you to Pershing Square Holdings Limited, (if you haven’t been already), arguably one of the smartest and highest yielding hedge funds on Wall Street. Bill Ackman, the penultimate decision maker and really the person who runs the place, has been long known as an aggressive yet cautious investor, who’s always on the lookout for better returns and quirkier financial instruments.

He hasn’t always been right, Pershing Square lost about a billion dollars on this very controversial short position of the multi level marketing firm, HerbalLife, while also netting about $2.4 Billion with another short position, just before ‘hell’ began, as rightly pointed by him on March 25th, 2020: “Hell is coming”.

His trade techniques & antics are for another day but the talk here is about Pershing Square Tontine Holdings Limited, Pershing Square’s own SPAC which has raised about $4 Billion divided into 200 million units at $20/unit trading with the ticker symbol of PSTH representing one unit in the SPAC. (Ostensibly the most inexpensive SPAC from investor transaction cost POV)

One unit entitles the sponsor for one share of PSTH’s Class A common stock and 1/9th’s of one Redeemable warrant also known as ‘Distributable Redeemable Warrants.’

It might sound like gibberish, which is why read carefully,

1/9th’s of a warrant is the same concept explained under ‘How does a SPAC work”.

This begs the question, what is the ultimate utility of this warrant? Read on

We know that a SPAC is formed with the sole motive of merging with another company, so conclusively, all I want in my portfolio as an individual investor is a great price for a great investment guaranteeing even better returns. That is exactly what this is about, regardless of the price of the stock after the merger, each complete warrant, i.e 9 such partial warrants issued in the above mentioned unit can be converted into another share of Class A common stock itself meaning you have the right, not the obligation, much like how an option works, to purchase another Class A common share of the merged company at a predetermined price of $23 per share in addition to one Class A common stock that you already hold by virtue of purchasing the SPAC unit. (Please keep in mind warrants can be exercised only after the warrants & shares start trading separately which in this case company expects will start doing so, on or before the 52nd day following the consummation of the IPO, i.e when the acquired company starts trading on the stock exchange.)

This will effectively lead to two separate instruments trading on the stock exchange, the PSTH ticker representing one share of Class A common stock of the merged company and PSTH.WS ticker representing one complete warrant, both stemming originally from the $20 unit of the SPAC. I hope by now, it’s all in black & white.

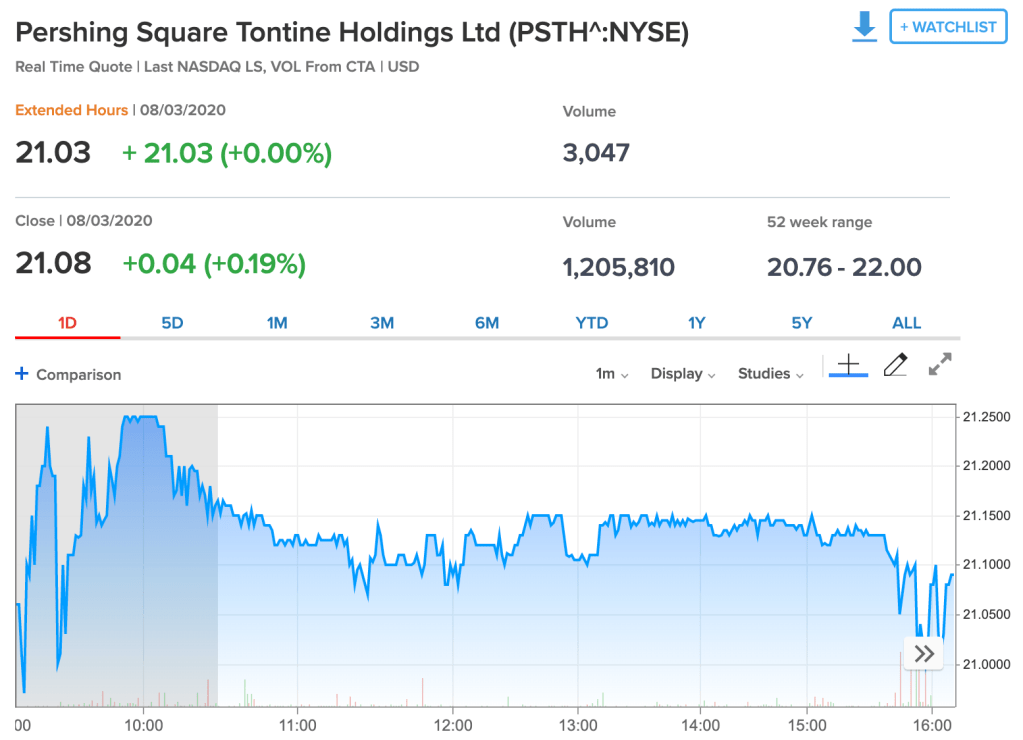

Here’s a snapshot of how the PSTH ticker has performed on the NYSE since its listing on July 22, 2020.

The intention is clearly mentioned by Bill, which is to take this money and merge with a private company for a minority investment in its shares. So a controlling stake/100 % ownership has been clearly ruled out by the man, which is why it makes this diversification an insurance against the ‘all in’ mindset of some investors.

Another notable feature of this SPAC as reiterated by Bill himself, is they’re looking to invest in “very high quality, growth companies that they’re looking to take public in an IPO” (my guess is Elon’s SpaceX), while also mentioning “we’re not speculative investors” and “we’re not going to invest in a currently zero cashflow, large potential tech company, such as ‘Waymo’.”

Finally, where do I find SPAC’s in India?

To keep this answer short, you can’t. SPAC’s don’t exist in India yet, although there are numerous SPAC’s looking for targets to acquire in India.

A few examples are listed below:

- Trans India Acquisition Corporation’s (TIL) reverse merger with Hyderabad based photovoltaic (PV) modules maker Solar Semiconductors Ltd. This SPAC acquired an 80% stake for $375 million while also assuming long term indebtedness in excess of $50 million of Solar Semiconductor.

- Phoenix India Acquisition Corp acquiring 65% stake in Citius Power Limited.

- Millennium India Acquisition Company’s acquisition, for a 14.9% stake in Delhi based brokerage firm SMC Global ≈ $40 million

East India Company Acquisition Corp. & Global Services Partners Acquisition are the other SPACS scouting for targets in India.

Why aren’t SPAC’s operational in India yet? Well that’s because there are a sizeable amount of Roadblocks, what are those?

What you need to know is that while SPAC’s don’t intend to carry out a business of their own, their sole ‘business’ is to consummate a merger with another company, and that doesn’t really sit right with the Companies Act 2013’s Objects Clause which is part of what is known as a Memorandum of Association for a company incorporated in India while it isn’t entirely ultravires, it might not be able to match the excitement of company on route to a conventional IPO.

An SPAC would essentially be operational only after an IPO, but for an IPO to happen, the SEBI, ICDR of 2009 mandates every company in india willing to list itself through an IPO to have a certain level of net tangible assets, distributable profits along with a commensurate level of net worth, which seems pretty obnoxious for a SPAC, pre-IPO, along with further hurdles at both the BSE & NSE in terms of listing pre-requisites which make it seemingly difficult for a firm, whose presence in the country has not been marked by sizeable years of operation or a stellar business record in terms of key financial metrics.

And finally, even if all these regulations are satisfied/amended to make for a conducive business environment for SPAC’s, the Substantial Acquisition of Shares and Takeovers Regulations of 1997, better known as the takeover code, meant for protecting the plethora of investors in a public company while also protecting their minority interests may seem to delay any effort to expedite the process of operating a SPAC in India.

Before I leave you with this, it is high time for the Indian markets & regulators to encourage and pave the way for SPAC’s in our financial markets, especially at a time with exponentially growing retail investor participation within Indian stock markets.

These are my two cents, thanks for reading.